In what is sure to become a battle of talking heads, the Alaska Film Alliance (AFA) recently formed to question the state’s film subsidy program (the most generous in the nation). Worth noting here is that the group, fronted by conservative organizer Bernadette Wilson, is not asking for the end to subsidies. The group had this to say:

AFA’s first goal is to advocate for changes in the Alaska film incentive program. The group sees the program’s re-authorization legislation currently pending in the state legislature (SB 23) as seriously flawed. Now may be the last opportunity to tweak the program in several key areas. Among AFA’s concerns are: reform of the credit/broker incentive system, more support for Alaska based businesses wishing to work with out of state filmmakers, better incentives for hiring Alaskans, the creation of a workforce development program, and using a small portion of the tax credits to build film and media infrastructure in Alaska.

There are reasons for concern. As Dermot Cole writes in the Fairbanks Daily News – Miner:

- In the first three years of the Alaska film subsidy program, the state has paid out more in tax credits than the companies spent in Alaska, when you subtract the $28.6 million in wages that went to movie stars, film executives and other employees from Outside.

- The 30 productions that have received credits so far have spent a total of $12.3 million in Alaska and received $13 million in tax credits, according to state figures.

- The new information released by the state says that 695 direct Alaska jobs were created in the past three years and 516 non-Alaska jobs were created. The problem with these numbers is $28.6 million went to the people from Outside in wages and $3.1 million went to the higher number of Alaskans.

Alaska is not alone in questioning the value of film subsidies in an era of strained state budgets. Michigan, which once had an “unlimited film subsidy program,” recently approved legislation to cap the subsidy at $25 million. New Mexico also capped its film subsidy program in a compromise with the governor, who wanted to reduce rebates to 15%; the compromise resulted in a $50 million cap, down from $77 million in 2009.

The real question, however, is whether these compromises go far enough. A 2010 State Senate study of film incentives in Michigan brought back some startling numbers. In 2010, the incentive program cost the state $117 million and created 1,039 full-time jobs. That breaks out to a cost of $112,608 per job. Even taking into consideration the tax receipts generated by the subsidized productions, the program had a net loss of $60 million. A Louisiana study shows similar results, with only a 13- to 18-cent return for every dollar spent.

The most in-depth study of film subsidies was conducted by the Massachusetts Department of Revenue in 2009. Here’s what they found:

- Massachusetts lost $88,000 in tax revenue for every new job created by the Commonwealth’s film tax credit and filled by a Massachusetts resident.

- Every dollar of state tax revenue lost because of the film tax credit generated less than 69 cents in income for the Commonwealth’s residents. The Commonwealth could have given its citizens a bigger financial boost at a lower cost by repealing its film tax credit, recouping the tax revenue, and sending them checks in the mail.

- For every dollar of film tax credits awarded to film producers, the Commonwealth gained only $0.16 in revenue, mostly in the form of income tax revenues withheld from film company employees. The remaining $0.84 had to be financed by higher taxes elsewhere or cuts in public services. Independent studies of film subsidies in other states have estimated similar financial costs, ranging from $0.72 to $0.93 per awarded subsidy dollar.

Given this reality, one has to ask why states are buckling under and merely revising their incentive programs, rather than scrapping them altogether. The answer largely comes down to the efforts of the Motion Picture Association of America, with its cadre of lobbyists and faulty studies; the Tax Foundation notes, for example, that one MPAA study reached positive numbers “by taking credit for all economic activity remotely related to film production.” Still, one wonders what answer the MPAA has for films like “House of the Rising Sun.” The movie, filmed in Michigan, took in $100,000 in DVD/Blu-Ray sales, but cost Michigan taxpayers $435,000.

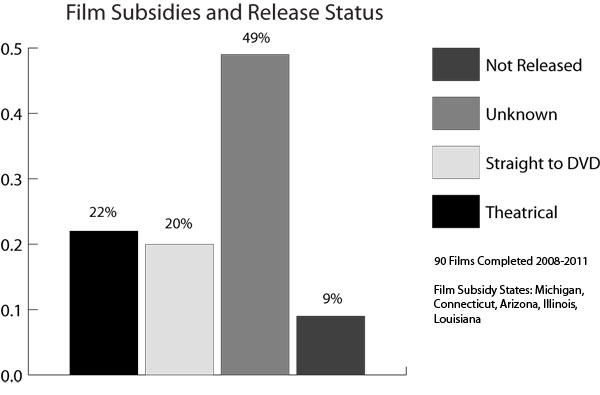

Our own study, of 90 state subsidized films from 2008 through 2011, shows that filmgoers will be extremely lucky if they see any of these movies. One thing for sure: corporate welfare is alive and well. Thank you, MPAA.

NOTE: The “Unknown” category includes a large percentage of what the industry calls “shelved” films. A film can be shelved for a variety of reasons, including poor reactions from test audiences, which causes film producers to shelve it rather than spend additional money to print and promote the film. State film incentive programs are, of course, poorly equipped to deal with this reality.

NOTE: The “Unknown” category includes a large percentage of what the industry calls “shelved” films. A film can be shelved for a variety of reasons, including poor reactions from test audiences, which causes film producers to shelve it rather than spend additional money to print and promote the film. State film incentive programs are, of course, poorly equipped to deal with this reality.

1 thought on “State Film Incentives: Gone?”